Loading...

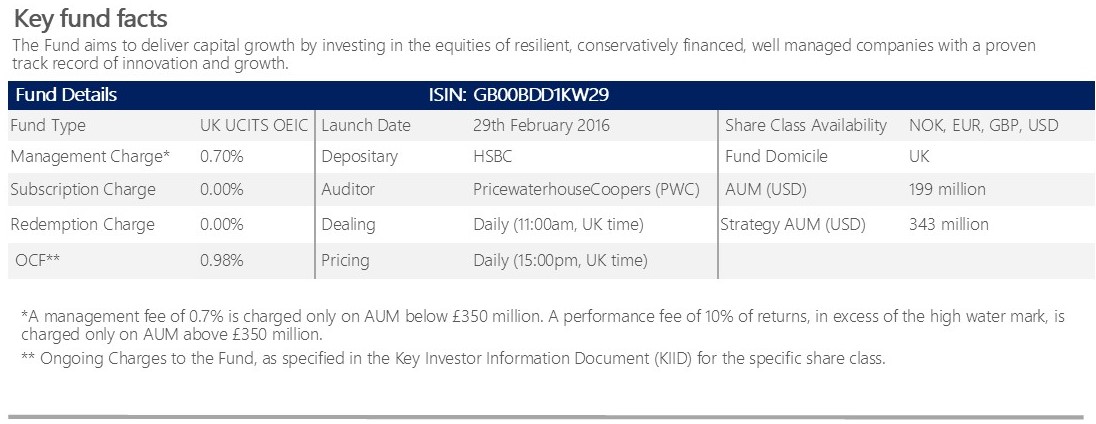

The Equitile Resilience Fund (UK-domiciled) aims to deliver capital growth by investing in large, growing companies in the developed markets. It is managed according to our core investment principles and uses the Equitile Fair Fee Model.

The Equitile Global Equity Fund (Ireland-domiciled ICAV) follows the same strategy and principles as the Equitile Resilience Fund. The lastest update and other documents can be found here.

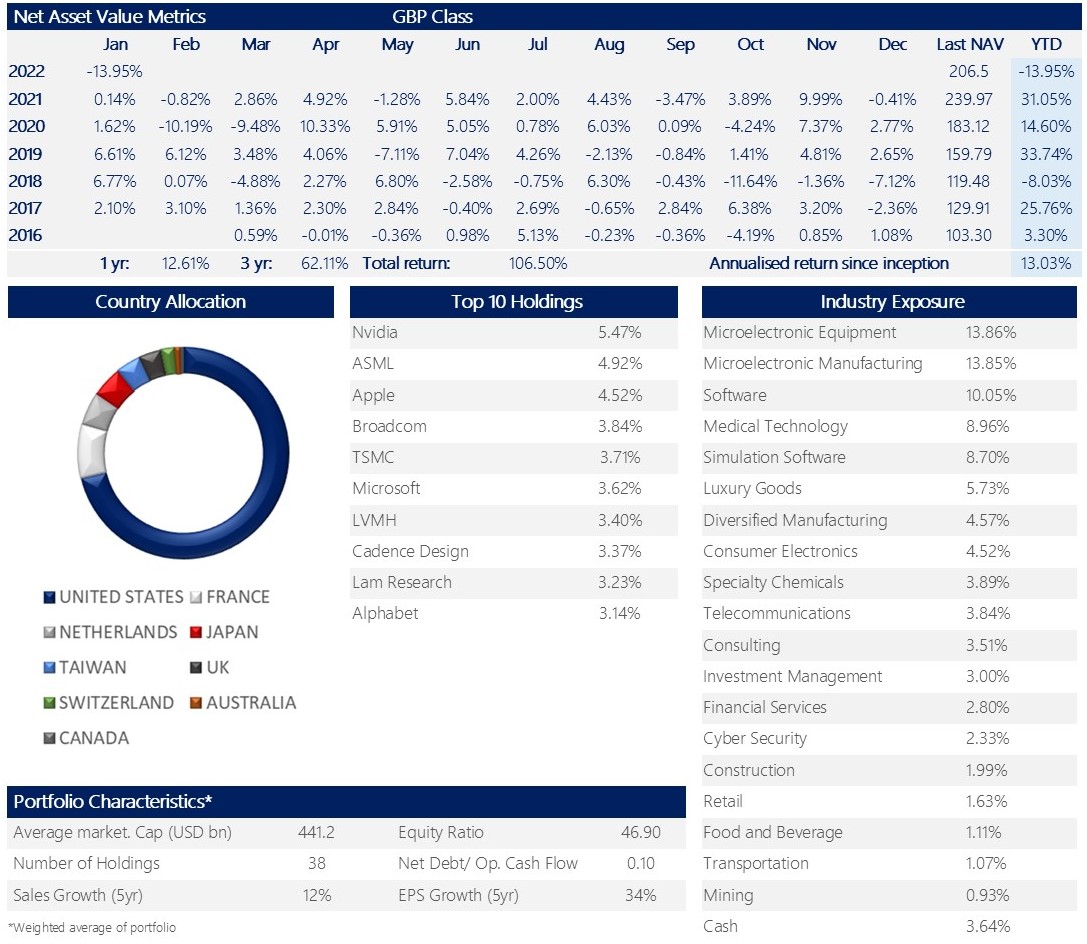

Latest Overview - January 2022 (Print version: GBP Class, USD Class, EUR Class, NOK Class)

January has witnessed a setback for your portfolio, which suffered its largest single monthly pullback since inception. Two factors, both macroeconomic in nature, came together in January to push markets into a mood of extreme risk aversion. Firstly, there was a heightened level of concern over the possibility of military conflict between NATO and Russia over Ukraine. These concerns are arguably being exacerbated by the domestic weakness of both US President Biden and UK Prime Minister Johnson, a situation in which foreign policy misjudgement become more likely. Secondly, there was a similarly heightened concern that the US Federal Reserve would begin pushing up interest rates at a faster pace than previously expected, to counteract the elevated level of inflation.

January has witnessed a setback for your portfolio, which suffered its largest single monthly pullback since inception. Two factors, both macroeconomic in nature, came together in January to push markets into a mood of extreme risk aversion. Firstly, there was a heightened level of concern over the possibility of military conflict between NATO and Russia over Ukraine. These concerns are arguably being exacerbated by the domestic weakness of both US President Biden and UK Prime Minister Johnson, a situation in which foreign policy misjudgement become more likely. Secondly, there was a similarly heightened concern that the US Federal Reserve would begin pushing up interest rates at a faster pace than previously expected, to counteract the elevated level of inflation.

In combination, these two risks were enough to make this January one of the worst in history for stock markets. In the 50-year history of the NASDAQ, only January 2008, during the hight of the global financial crisis, was worse.

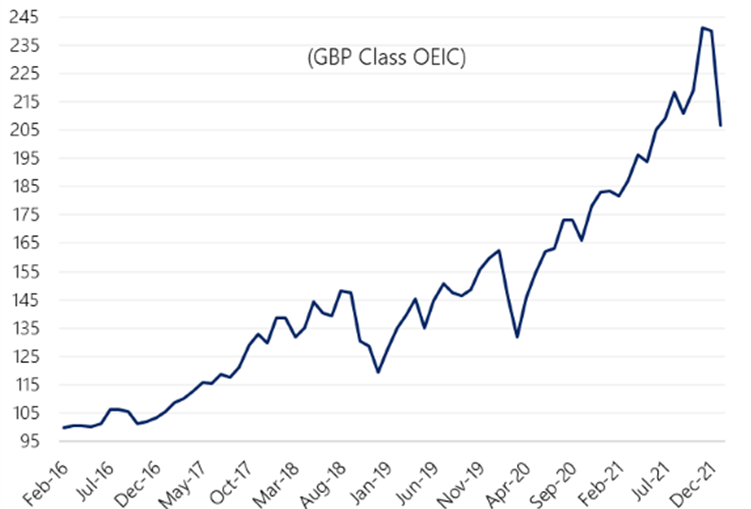

That said, the moves in January should be considered in the context of the abnormally strong stock market performance in the final quarter of 2021. In aggregate, January’s setback has taken the valuations of your portfolio only back to where they were in October of last year.

As things stand, we anticipate the sabre rattling over the Ukraine will soon begin easing as will the market’s fears over Fed Chairman Powell’s proposed normalisation of interest rate policy.

Overall, we do not assess January as marking a regime change for the stock markets and have therefore made only minor adjustments to your fund. We have however added three new holdings to your fund in the month, albeit with only small allocations so far.

| Share Class | Minimum Investment | Minimum Further Investment | Minimum Holding | Initial Charge |

| A Acc | GBP 10,000 | GBP 5,000 | GBP 5,000 | 0% |

| A1 Acc (OEIC class) | GBP 10,000 | GBP 5,000 | GBP 10,000 | 0% |

| B Acc | EUR 10,000 | EUR 5,000 | EUR 5,000 | 0% |

| C Acc | USD 10,000 | USD 5,000 | USD 5,000 | 0% |

| E Acc | NOK 100,000 | NOK 50,000 | NOK 50,000 | 0% |

| Share Class | Valued on | Currency | KIIDs | Mid-Price NAV | Daily Change (%) | |

| A Acc | 25 Mar 2022 | GBP | View file | 210.31 | 6.59 | |

| B Acc | 25 Mar 2022 | EUR | View file | 223.35 | 6.68 | |

| C Acc | 25 Mar 2022 | USD | View file | 247.9 | 3.72 | |

| Class A1 | 25 Mar 2022 | GBP | View file | 214.39 | 6.67 | |

| Class X3 | 25 Mar 2022 | USD | View file | 234.84 | 3.74 | |

| E Acc | 25 Mar 2022 | NOK | View file | 188.88 | 0.93 | |

Invest

1

Invest

1

Insights

1

Insights

1

Chart Room

1

Chart Room

1

Responsible Investing

1

Responsible Investing

1

Revival of the Fittest

2

Revival of the Fittest

2

George Cooper Talks to Bloomberg Radio - Central Bankers Are Irresponsible

2

George Cooper Talks to Bloomberg Radio - Central Bankers Are Irresponsible

2

Bloomberg Radio - Equitile’s Cooper: How to Fix Economics

2

Bloomberg Radio - Equitile’s Cooper: How to Fix Economics

2

How we invest

1

How we invest

1

Fair Fees

1

Fair Fees

1

Fund Documents - Resilience Fund

1

Fund Documents - Resilience Fund

1

Brochure

1

Brochure

1