Loading...

9th September 2019

In US financial and political circles, the virtue of companies buying back their own shares is a subject of hot debate. While Democratic presidential candidates, Elizabeth Warren and Bernie Sanders, say that curtailing them would be a crucial step in reducing inequality and increasing investment, the evidence is far from clear.

In US financial and political circles, the virtue of companies buying back their own shares is a subject of hot debate. While Democratic presidential candidates, Elizabeth Warren and Bernie Sanders, say that curtailing them would be a crucial step in reducing inequality and increasing investment, the evidence is far from clear.

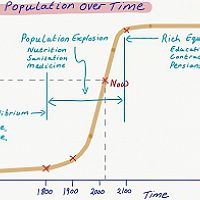

When it comes to the stock market, buybacks present investors with a dilemma – at the current rate, logically speaking, the US stock market would have been fully privatised by 2050, leaving investors with no choice but to buy while stocks last.

Hedonism and the value of money - Part I

2

Hedonism and the value of money - Part I

2

Meerkats and Market Behaviour - Thoughts on October's stock market fall

2

Meerkats and Market Behaviour - Thoughts on October's stock market fall

2

In Search of Stability & Growth - If only Europe was more like the US

2

In Search of Stability & Growth - If only Europe was more like the US

2

Build a company on prudence and trust, not debt

2

Build a company on prudence and trust, not debt

2

Tales of an Astronaut - Lessons from the Unknown

2

Tales of an Astronaut - Lessons from the Unknown

2

Investment Letter - Constant Reformation

2

Investment Letter - Constant Reformation

2

Depressed lobsters and the dividend yield trap

2

Depressed lobsters and the dividend yield trap

2

Monetary Policy on a War Footing

2

Monetary Policy on a War Footing

2

2016: A Tale of Two Walls

2

2016: A Tale of Two Walls

2

Modern Monetary Theory - The Magic Money Tree

2

Modern Monetary Theory - The Magic Money Tree

2

Facts not Opinions

2

Facts not Opinions

2

Reckless Prudence - How to break a pension system

2

Reckless Prudence - How to break a pension system

2

The Anxiety Machine - The end of the world isn't nigh

2

The Anxiety Machine - The end of the world isn't nigh

2

Hanging the Wrong Contract?

2

Hanging the Wrong Contract?

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

Norway Moves to America - Mean reversion and industrial revolutions

2

Norway Moves to America - Mean reversion and industrial revolutions

2

An Impossible Trinity?

2

An Impossible Trinity?

2

Regulating Psychopaths

2

Regulating Psychopaths

2

Revival of the Fittest

2

Revival of the Fittest

2

Hedonism and the value of money - Part II

2

Register for Updates

12345678

-2

Hedonism and the value of money - Part II

2

Register for Updates

12345678

-2